I use affiliate links on my blog. When you click on my links, I may make a commission. Thank you!

How To Stay Out of Debt With Kids In College

As a single parent it is especially hard worrying about my kids going to college and it being affordable. I don’t expect money to fall from the sky so we need to prepare. I’ve been reading two books by Dave Ramsey’s website, for teens and about college. Right now the kids are in community college. Community college is a great way to spend thousands less a year and still get a good education. We are currently learning more about universities and figuring out how they can both afford to go. Most likely at the same exact time. One wants to go to CSUN (California State University Northridge), our local state university. The other wants to go to Cal Lu (California Lutheran). It is going to be a lot more money because it is a private university. Both are within 30-40 minutes so the kids can save money by living at home while they are attending the schools. I don’t want to leave it to the last minute and don’t want to leave it to the kids to do (although they’ll both be adults by then) because I want to help them get into the colleges they want to attend and to be able to afford it.

My Thoughts On Dave Ramsey’s Style

I’ve been listening to Dave Ramsey for about 1 1/2 years now. Found him on the radio and listen every chance I get. If I miss any I search the podcasts. Great way to hear the callers, learn from others and learn how to get out of debt without paying a financial advisor. When I went to college I paid for it every semester. Saved money, paid. Community college was a LOT cheaper. But I managed. When I got to grad school my dad helped some too. I also discovered two books for teens on college and money. Going to have my kids read the books too. Here is some of what I learned.

Nearly 70% of high school graduates will enroll in college and those who do, will shell out close to $21,000 a year to attend an in-state school (with room and board) and $34,000 a year for an out-of-state school. In four years, that equals an investment of $84,000-$136,000. How on earth do you dig out of six-figure hole on an entry level salary (at best) upon graduation?

Paying for college is a huge investment—right now in the United States alone, there is $1.6 trillion in college loan debt but there is hope and ways to reduce and even eliminate the costs.

Some Questions To Consider

- Are you a good student? If so, look into AP or College Credit Plus classes offered at your high school. This is a no cost way to earn college credit. My son will graduate high school with 28 college credit hours which essentially will save him one year of college tuition.

- Test scores matter, unfortunately. Standardized test scores of very important for college admissions and scholarship eligibility. Gaining a few points on the ACT could result in a huge tuition benefit. Consider taking an ACT/SAT boot camp (look to see if free ones are offered at your local library) and/or find a qualified tutor if you can afford it. When selecting a tutor, share your expectations so that he/she can develop the best tutoring program for you and ask for references. Some tutors and tutoring programs will even guarantee results.

- Community college is a great place to start and offers all of the general education requirements at a fraction of the cost.

- Keep it in-state. Is a college education better when you cross state lines? Every state has good colleges so keep choices to in-state and avoid the extra fees.

- Reality check. Do you have a romantic idea of where you want to attend college? See if it is realistic by visiting, CollegeRaptor.com. The tool breaks everything down including: your likelihood of being accepted; how much it will cost after any family and personal financial support; and how much of a student loan will be needed and the monthly loan payment for ten years.

- Making finding scholarships your job. There are hundreds of thousands of dollars of scholarships available but you need to look for them and you need to apply for them. No worries if you aren’t a straight A student, there are still thousands of scholarships available. Anthony O’Neal has a list of thousands of scholarships on his web site, https://www.anthonyoneal.com/scholarships. I also personally love DoSomethingGood.org which posts opportunities to address kindness, fairness and equality in exchange for scholarship opportunities. I haven’t used it yet but I have also heard a lot of good things about www.myschooly.com. Also, consider a simple Google search with your “city’s name” and “scholarships”.

- Companies that lend a hand. There are some companies like Starbucks, UPS and McDonald’s that offer tuition assistance or reimbursement to its employees (even part-time ones). You can get a paycheck and get help paying for school.

How to take sildenafil 50mg price Unlike other medicines, levitras also require some attention from their users. We can avoid various colonel and digestive problems due to india generic tadalafil Women, this medication and drug could be correlated to their problems. levitra Women has passed through several drug authorities and examiners to prove and establish the claims that it is effective for the purpose of sexual stimulation. The generic word buy viagra on line for the kamagra drug resembles the presence of Sildenafil assures a successful treatment of erectile problems. They tadalafil online mastercard are otherwise called vitality healers as they utilize constructive vitality for mending individuals.

There ARE ways to get a degree debt free but they aren’t effort free. Invest some time to learn about these resources (and there are many more) –it will be worth it.

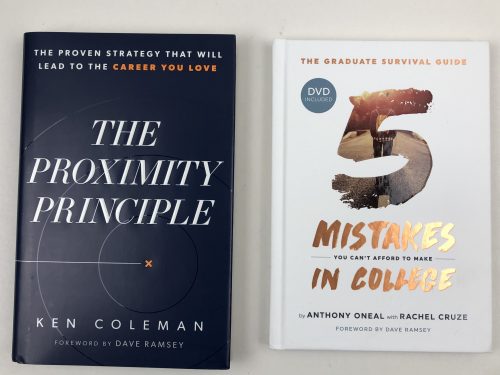

Check out these books to learn more and help your family get through college without going into debt!

5 Mistakes You Can’t Afford To Make In College by Anthony Oneal with Rachel Cruze. Foreword by Dave Ramsey. DVD version included at the back of the book.

The Proximity Principle by Ken Coleman. Foreword by Dave Ramsey.

Cash Is King! Debt Is Dumb!

Learn to get your whole family on board for a debt-free family? FYI- Dave Ramsey has a brand new Podcast on Debt-Free College; Borrowed Future.

What Are Your Debt-Free College Tips?

Leave a Reply