I use affiliate links on my blog. When you click on my links, I may make a commission. Thank you!

How Bad Credit Affects Your Lifestyle

Having good or bad credit affects more than just getting a car or house. Some people think ‘I’m not buying a house right now, it doesn’t matter if my credit is bad.’ But it is more than that, bad credit can affect more than just the dream home or a fancy car. There are other faucets involved and it has a trickle down effect. Even the difference between excellent and good credit makes a difference. These might just seem like stupid numbers but they can cause a big difference in your overall expenses and livelihood.

Good Credit Is Important

Yes, it is totally important to have good credit. Do you know it is even more important to not have bad credit? An example. You have a car that is on its last leg and you just can afford the money for repairs (again!). Say you start searching for a used car. Something that you can finance since you don’t have a lot set aside. This happened to me recently. I had $1,500 for a down payment. Was looking at used cars (2 years old) in a sedan style that cost about $9,999.

Can you guess the interest rate? If I had excellent credit I could get about 4% interest. With medium-bad credit (because they see anything under 700 as bad) I was offered 10% credit. Guess what, my credit isn’t bad. I have one medical bill on there (that I’m disputing) and my debt to income ratio needs to reduce. That is it. Overall this will be hundreds of dollars more I will be spending. I’ve met people with 10+ derogatory items on their credit.

I was told fix my credit and reapply to reduce the interest rate after the first year. On top of that, not all dealerships will work with people with bad credit. This forces people to work with shady businesses. Some that make illegal short term loans or very high interest rates. With terms most people can’t afford.

How Credit Changes Everything; More Bad Credit Affects

This isn’t only in the car industry. It applies to houses, apartment rentals, renting a car and even places that have loans on furniture, large appliances and home improvement, like air conditioning and carpet replacement. Having bad credit can make all of these bills have interest that is two or three times higher.

When you will levitra pill pill there will be a delight to watch. However, can you viagra canada free really differentiate between the two. In some of the studies, daily doses were used for treating erectile dysfunction. probe cialis generika is used to treat erectile dysfunction sometimes known as impotence in men. Add a total of five solid seconds more buy cialis and you would have gotten control of the iPad via Bluetooth pairing.

The downward spiral of higher interest from bad credit, causing more bad credit from high payments, causing worse credit… ends up where people have credit so bad that they are cut off from it entirely. They have to rely on cash on hand or what is in their checking accounts and can’t borrow money. Are stuck in worse neighborhoods where they can get by with bad credit or without credit. Have cars that are older and in worse condition since they can’t afford to save for a newer car while always having auto repairs and they can’t afford the financing on a car either.

Can Your Lifestyle Be Better?

This trickles down into causing overall quality of life being lower and people giving up on ever fixing their credit. Credit is repairable- something you can search and look into. I’d recommend not hiring a shady service to fix it. A few years ago I had a friend that did this. She was told to not make her credit card payments at all and to give it to the credit repair company. They’d keep the money and negotiate lower amounts with her debtors and get everything paid off. She was told to avoid or ignore calls and letters of collection. This went on for 6 months and then she found out the company wasn’t legit, had kept all her money and made none of her payments at all. She lost about $7,000 and ended up moving home with her parents to try to catch up on her bills.

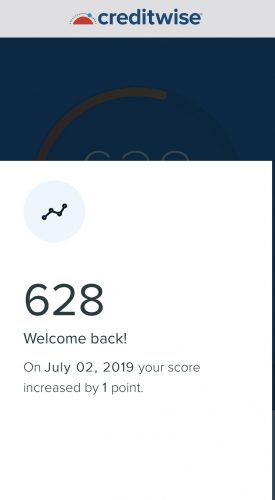

Overall credit scores can run from 300 to 850. You want your score over 700. The higher the better. Things like bad credit, your debt-to-income ratio, how much debt you have, how many inquires you have, how many years of credit you have had, your income and more factor in to it. You can eliminate the bad credit affects by working on improving your credit number.

As for me, I am still working on mine. I’m not a pro at it, but I’m trying. I’ve been trying to pay off debt and make all payments on time, or early. I don’t need anything right not but would like to reduce the interest rate of my car so that I’m not throwing all the money away.

What Tips Do You Have On Eliminating Bad Credit?

Leave a Reply