I use affiliate links on my blog. When you click on my links, I may make a commission. Thank you!

Getting Your Family On Board With Debt Elimination

Dave Ramsey Style

So you’ve made a decision to get you and your family out of debt. You’ve made an iron-clad commitment to do so. You know it’s the only way to a happier and more secure future. However, you’re a bit apprehensive about telling your family that changes and sacrifices are required. You’re worried that your spouse and children will not share your commitment and willingness for sacrifice. Worry no more. Read on for help about how to talk to your loved ones.

First, have a conversation with your spouse. Frankly, your spouse is much more important than the kids in this situation. Your spouse has the ability to spend money and make financial decisions. Without your spouse making the same commitment that you have made to cutting spending, avoiding taking on another penny of debt, and paying off current debts with persistence and regularity, your efforts will be for nothing. Begin by being honest and sincere with your spouse. Tell him or her that the family’s current spending habits and financial situation are a disaster and must change. Talk about the commitment you’ve made and ask your spouse to join you. Most spouses will acknowledge the problem especially if you’re sincere and direct about it. Admit that the blame is not all on them and that you also bear responsibility for the family’s situation. If they are on board thus far, go on to the specifics of how you can reduce spending and begin paying off chunks of debt.

If your spouse is a bit resistant, before proceeding to discuss the details, say that the situation is unsustainable and absolutely cannot continue. Bring up that the material things that got you into this mess are not the source of happiness. Tell him or her that the most important thing to you is him or her and your kids. That you value being together more than buying more stuff and you want to build a more secure, happier future for the family. Explain that you want the family to have a future with freedom. A future where you can spend more and do more in a financially sustainable way. You no longer want the family to be hounded by creditors. This starts with paying off debt. Once your spouse is on board with this, proceed to discussing the financial details.

When discussing the details, you can explain to your spouse that you were inspired by famous debt elimination expert Dave Ramsey. You can even direct your spouse to some of Dave’s work. Explain that Dave’s Baby Steps are the foundation of your plan for the family’s brighter financial future. There are seven Baby Steps which can be seen on Dave Ramsey’s website. Tell your spouse that before implementing the Baby Steps, Dave recommends first making a decision to change, then refusing to take on more debt, and then eliminating current debt with his “debt snowball”. You have made this decision to change and this is why you began the conversation to get him or her on board with you. Next, explain to your spouse your plan for cutting spending to avoid additional debt. After this, you can explain to him or her the “debt snowball” as presented by Dave Ramsey. Your family will pay off its debts beginning with the smallest and ending with the largest. This will allow you to take some items and accounts off your plate early. It will also allow you to celebrate some small wins to keep up motivation. Keep putting all excess money towards paying off debts. Only purchase the essentials.

After paying off your debt, explain to your spouse that the family can then implement the baby steps. Such as saving money for an emergency fund, first having 1000 dollars on hand and latter building up three to six months expenses in savings. Your family will also begin to save and invest for retirement and the children’s college, pay off your home early, and then begin to build wealth. Eventually, you will even have enough to give to charity as well. Again, you can read more about Dave Ramsey’s Baby Steps here. Paint this vision of the future very clearly to your spouse. It is an amazing future isn’t it? Many dream of a financial future like this and your spouse will be no different. The solid future of the Baby Steps will further when them over to your commitment to be debt free. In the future, when the sacrifices and difficulties of lifestyle change and debt elimination come up, you can remind your spouse of this future of financial solidity to maintain motivation and commitment.

With your spouse fully on your side, the two of you can approach the kids together and have a family discussion. Now, if your kids are below a certain age and wouldn’t notice or comprehend, obviously this step is not needed. Assuming, they are old enough to notice changes and sacrifices, get them together as a family and be honest and vulnerable with them. Tell them that the family has some problems and that sacrifices are needed. Acknowledge your fault in the problems. Tell them not to worry though because you have a plan and that plan will create a better future for the family. Tell your children you love them and want the best possible future for them. Make sure they understand that each family member is making sacrifices, including you.

Remember spouse first and then kids together. Be frank, honest, sincere, and loving. Use the Baby Steps as a guide and as inspiration. Share the responsibility and everything will go fine. Lastly, remember that being consistent is key for achieving this. Each time you are tempted with buying something you don’t need, remember that every little decision matters. Five dollars might not seem like much, especially in the face of all that debt. However, would you rather be five dollars closer or farther from your goal? Habits form easily and spending five extra dollars can easily turn into ten, twenty or one hundred dollars. Be disciplined, be consistent, advanced bit by bit toward your goals, and you and your family will achieve them together.

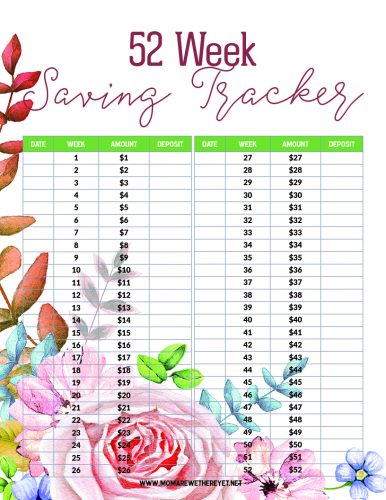

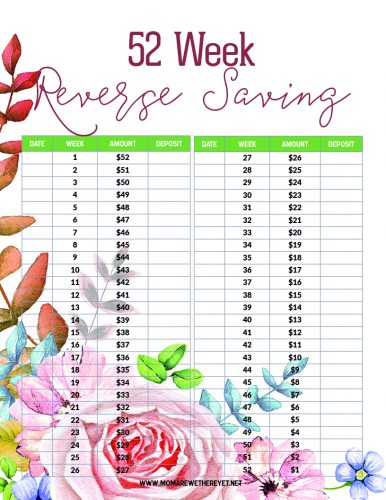

You can also check out these printable savings trackers to help you weekly for the whole year.

52 Weeks Saving Tracker Printable

I know I missed the boat getting these posted before 1/1 but it isn’t too late to jump into this and start now. These are two great ways to save money throughout the year, in baby steps, just doing a little bit every single week. Not only that, both printable. The first is a 52 weeks reverse saving and the second is a 52 weeks saving tracker. Work with the one that you like the best or works best with your budgeting and lifestyle. You might want to save money for emergency funds, for a new car or other large expense, for something a little smaller, like a laptop, or to pay off all debt and be debt-free.

52 Week Saving Tracker

52 Week Reverse Savings Tracker

Leave a Reply